McGraw-Hill Education Malaysia 2013. Q2 Define a person under the Income Tax Act 1967.

Oxford Fajar Companion Website

Any foreigner who has been working in Malaysia for more than 182 days considered as residents are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian nationals.

. Q3 The Government can introduce changes to the tax laws at any time to regulate and control the. All tax residents subject to taxation need to file a tax return before April 30th the following year. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Malaysian Master Tax Guide.

What people are saying - Write a review. 9789834728779 Based on 0 reviews. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021These proposals will not become law until their enactment and may be.

It explains the core tax concepts and principles. The foundation of the work is based on the major tax legislation in Malaysia namely the Income Act 1967 Real Property Gains Tax Act 1976 Sales Tax Act 2018 and Service Tax Act 2018. The book will be invaluable for students pursuing.

Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. Overview of Malaysian Taxation Q1 Double Taxation Agreement does not form part of the subsidiary legislation. Sales and Service Tax SST is the tax system that administered tax rates ranging from 5 to 10 essentially modelling the old SST system with some modifications in hopes to increase disposable income of the population due to the lower cost of goods and services.

A Guide to Malaysian Taxation Fifth Edition is an all-inclusive book covering every aspect of basic taxation. Browse discover thousands of brands. A Guide to Malaysian Taxation Fifth Edition is an all-inclusive book covering every aspect of basic taxation.

Read customer reviews find best sellers. All income accrued in derived from or remitted to Malaysia is liable to tax. It covers all the latest amendments including those arising from the Budget 2013 and recently issued exemption orders.

To complete a tax return expats need to fill out a Yearly Remuneration Statement EA. That said income of any person other than a resident company carrying on the business of banking insurance or sea or air transport derived from. A Guide to Malaysian Taxation.

The foundation of the work is legislation extracted from the Income Tax Act 1967. Up to 5 cash back A GUIDE TO MALAYSIAN TAXATION is an all-inclusive book covering every aspect of basic taxation. The book will be invaluable for students pursuing.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021. Choong Kwai Fatt Malaysian Taxation Principles and Practice Malaysia. This publication provides a concise yet comprehensive guidance on the essentials of Malaysian taxation to enable a working understanding of the law and practice of taxation in Malaysia.

A Guide to Malaysian Taxation Fifth Edition ISBN. This book will prove invaluable for the. Administrative and Technical Aspects Malaysia.

Failure to do so can result in a 10 increment of the payable tax or a disciplinary fee. Do foreigners or expatriates who are working and earning income in Malaysia need to pay income tax. McGraw-Hill Education Malaysia 2013 - Income tax - 524 pages.

- Write a review. Jeyapalan Kasipillai A Guide to Advanced Malaysian Taxation. As the SST system in Malaysia is a single-stage tax system goods which are sold and manufactured by a.

Income derived in Malaysia by a non-resident public entertainer is subject to a final withholding tax at a rate of 15. Veerinderjeet Singh Malaysian Taxation. The coupon code you entered is expired or invalid but the course is still available.

Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors employees. A Guide to Malaysian Taxation Fifth Edition REVIEW QUESTIONS CHAPTER 1. The foundation of the work is based on the major tax legislation in Malaysia namely the Income Act 1967 Real Property Gains Tax Act 1976 Sales Tax Act 2018 and Service Tax Act 2018.

Is this statement true or false. Your Instructor Song Liew Services We provide various company secretarial business process outsource tax and consulting services to our clients. The tax year in Malaysia runs from January 1st to December 31st.

This is the income tax guide for the year of assessment 2020. We havent found any reviews in the usual places. A BIP Guide to Malaysian Taxation Everything you need to know about Malaysian Taxation off original price.

2020 2021 Malaysian Tax Booklet

Service Tax On Cross Border Services The Onus On Malaysian Customer Or Foreign Service Provider

Good Practice In Tax Management And Strategy Nestle Global

Malaysia Issues Tax Exemption For Foreign Sourced Income

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

A Guide To Malaysian Taxation Jeyapalan Kasipillai 9789675771675 Amazon Com Books

A Guide To Malaysian Taxation Jeyapalan Kasipillai 9789675771675 Amazon Com Books

Malaysia Guide On Taxation Of Digital Services Kpmg United States

Malaysia Service Tax And Disbursements Reimbursements Kpmg United States

What You Need To Know About Malaysias Tax System

Malaysia U Turn Over New Law Taxing Foreign Sourced Income Hktdc Research

.png)

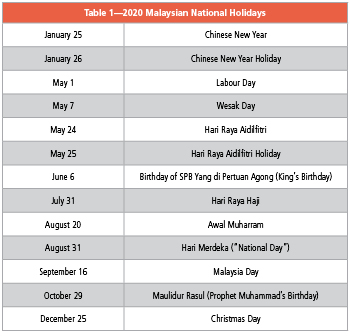

Malaysia Payroll Taxation Holidays Guide Remotepass Com

Guide To Advanced Malaysian Taxation Jeyapalan Kasipillai 9789675771682 Amazon Com Books

Tax Guide For Expats In Malaysia Expatgo

Malaysian Tax Issues For Expats Activpayroll

How To File Taxes For Self Employed Freelancers And Gig Workers Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel